10 Reasons to Have a Trust in Virginia

You’ve probably heard of trusts, but you may have wondered if they’re only for the wealthy or too complicated to be worth the effort. The truth is, trusts are powerful estate planning tools that can protect your family, your property, and your privacy—no matter the size of your estate. Families in Fairfax County and across Northern Virginia often discover that a trust addresses concerns a simple will cannot, such as keeping financial details private, planning for incapacity, and providing structure for children or other beneficiaries.

In this blog, we’ll share 10 important reasons to have a trust in Virginia and explain the steps you can take to put one in place for the people and property that matter most.

1. Reducing Probate Through a Trust

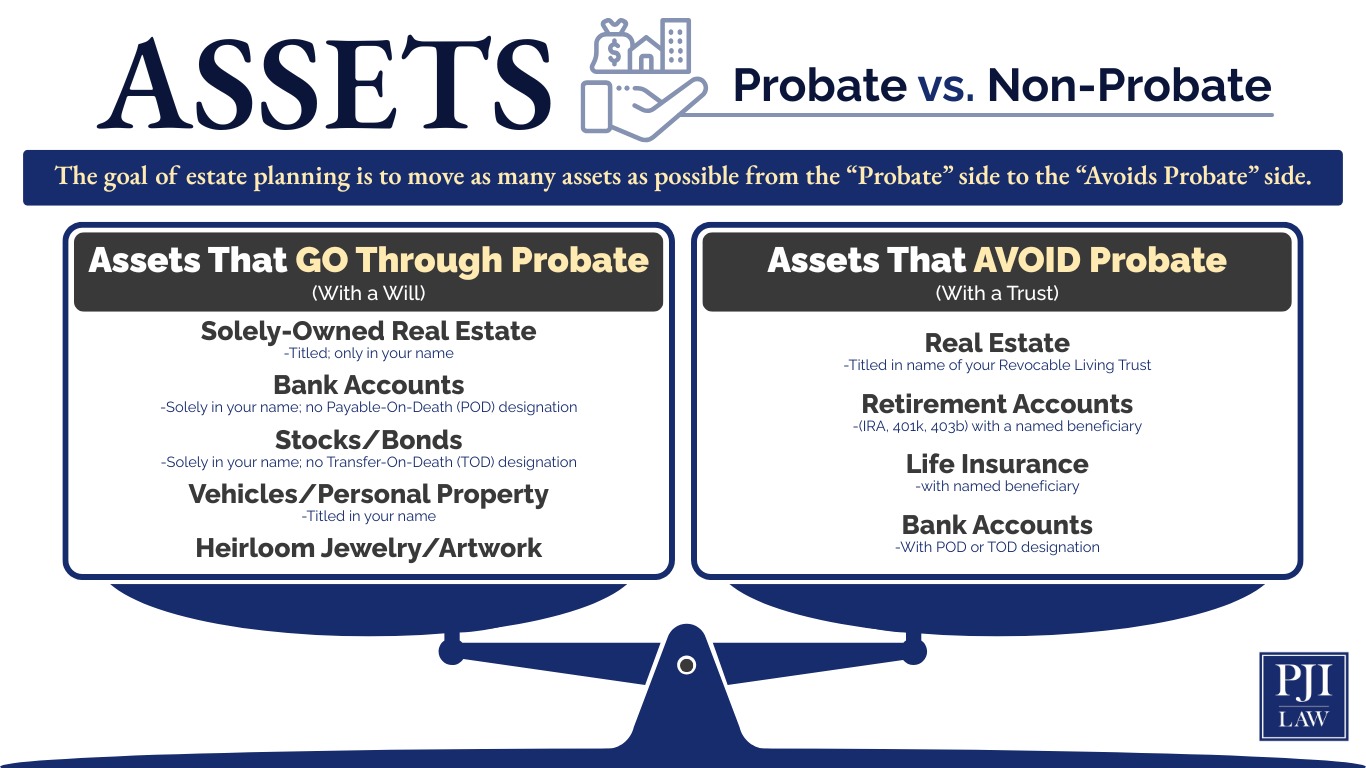

One of the first concerns many families have is how their property will be handled after death. In Virginia, if you rely only on a will, your estate must go through probate. A will is essentially a set of instructions for the court, and the executor you name must work with the probate court to distribute property. Depending on the size of the estate and whether disputes arise, this process can last years.

A trust changes the picture. When you transfer property into a revocable living trust during your lifetime, those assets bypass probate completely and are distributed directly to your beneficiaries by your trustee. Families often still use a pour-over will to catch any assets not moved into the trust, but only those “leftover” assets would go through probate.

This means a trust does not eliminate the need for a will, since only a will can appoint guardians for children. But by funding your trust properly, you can reduce probate to a minimal process and spare your family the delays and costs that come with relying on a will alone.

2. Protecting Your Family’s Privacy

Because a will must go through probate, the details of your estate become part of the public record. In Fairfax County and throughout Virginia, that means anyone can look up what property you owned, how much money you left, and who your heirs are. For families and business owners, that level of visibility can feel intrusive and even create risks.

A trust works differently. Assets transferred into a trust pass directly to your beneficiaries without court involvement, which keeps the process private. Instead of exposing financial details and family arrangements, the trustee distributes property discreetly according to the instructions you created. For many families, this privacy is just as important as the financial benefits of a trust.

3. Planning for Incapacity

Life is unpredictable. If you become incapacitated and cannot handle your own affairs, a trust allows your successor trustee to step in immediately and manage your assets. That means bills are paid, property is maintained, and your family has financial stability without interruption.

Without a trust, your loved ones may have to petition the court to appoint a conservator or guardian to manage your finances. That process is not only time-consuming and costly but can also feel invasive at a moment when your family is already under stress.

By naming a trustee in advance, you know that decisions about your money, property, and long-term care will be managed according to your instructions, not left to a court’s discretion. For many Virginia families, this peace of mind is one of the most valuable reasons to create a trust.

4. Providing for Children

One of the most common reasons Virginia parents create a trust is to protect their children. A trust allows you to decide not only who will benefit but also when and how they access financial support. Instead of leaving a lump sum at age 18, you can direct the trustee to use funds for specific purposes such as education, housing, or medical care.

This structure prevents young adults from accessing more than they are ready to manage and makes sure that resources are available when they truly need them. A trustee can oversee distributions until your children reach the ages or milestones you believe are appropriate. In this way, your estate provides long-term security without creating unintended problems, and you have confidence that your planning reflects both financial and personal priorities.

5. Supporting Pets

For many Virginia families, pets are part of the family. State law recognizes this by allowing you to create a pet trust to provide for their care after your death. Under Virginia Code § 64.2-726, you can set aside money for animals, appoint a caretaker, and give detailed instructions for their well-being.

This type of trust offers reassurance that pets won’t be left without support or passed between family members who may not be prepared to care for them. Whether you have one dog or several animals, a pet trust gives you a way to provide stability for them long after you’re gone.

6. Addressing Taxes and Wealth Transfer

Virginia does not impose a state estate or inheritance tax, which is favorable for many families. However, larger estates may still face federal estate taxes. For 2025, the federal estate and gift tax exemption is $13.99 million per individual (indexed for inflation), with amounts above this taxed at a top rate of 40%. Under the One Big Beautiful Bill Act of 2025, this exemption is now permanent and will increase to $15 million starting January 1, 2026, providing greater certainty for estate planning.

A trust allows you to structure how wealth is transferred. Instead of passing everything outright, you can stagger distributions, create ongoing management for younger beneficiaries, or shield assets from unnecessary taxation. Business owners in Northern Virginia often use trusts to transfer ownership shares, reduce tax burdens, and keep operations running smoothly without interruption.

For families focused on building long-term wealth, this level of planning provides stability across generations and protects what you’ve worked hard to build.

7. Managing Property Across State Lines

Owning real estate in more than one state can create unexpected challenges for your family. A will must be probated in each state where property is located, which means multiple courts, added legal fees, and delays in distribution. This process, called ancillary probate, can be especially burdensome if you own vacation property or rental homes outside Virginia.

By placing out-of-state property into a trust, you avoid those additional probate proceedings. The trustee can transfer or manage the property directly, reducing legal costs and streamlining the process for your beneficiaries. For families with property in both Virginia and elsewhere, this is one of the most practical benefits of creating a trust.

8. Keeping Control of Distribution

Another powerful reason to create a trust is the control it gives you over how and when your assets are used. With a will, property is typically distributed all at once, which may not fit your long-term goals for your family. A trust lets you set conditions, stagger payments, and shape distributions in a way that reflects your priorities.

For example, you might direct the trustee to cover educational expenses but delay larger distributions until a child reaches a certain age. A special needs trust can provide ongoing support for a child with disabilities without jeopardizing government benefits. You could also limit access for a loved one struggling with addiction or provide steady support for aging parents.

This level of control means your estate plan doesn’t just transfer wealth. It provides structure and guidance for the people you care about most.

9. Handling Legal Issues Efficiently

When someone passes away with only a will, the court stays involved until the estate is closed. That means delays, added costs, and potential disputes among family members. Trust administration in Virginia provides a different path. By naming a trustee, you give someone the authority to step in right away and manage property without waiting for probate court approval.

This streamlines the legal process, reduces the chance of conflict among heirs, and keeps the focus on carrying out your instructions. If disputes do arise, Virginia trust law provides mechanisms for resolution while still honoring the terms you created (Virginia Code Title 64.2, Chapter 7). For families, this efficiency means less time in court and more stability during a difficult period.

10. Creating Peace of Mind for the Future

Estate planning is not only about property and money. It’s about creating peace of mind for you and stability for the people you love. By putting a trust in place now, you protect your family from future uncertainty and provide clear direction at a time when they may be grieving and overwhelmed.

A trust reflects your priorities and values. Whether your focus is providing for children, supporting pets, or protecting a family business, a trust allows you to pass on more than wealth. It allows you to pass on security and a sense of care.

Now that you’ve seen the main reasons families in Virginia choose to create trusts, the question becomes what type of trust best fits your situation and how to set it up.

What Types of Trusts Can You Create in Virginia?

Trusts are not one-size-fits-all. Each serves a different purpose, and the right choice depends on your goals, your family’s needs, and the size of your estate. Common trusts used in Virginia include:

- Revocable Living Trust: Lets you keep control of your assets during your lifetime and adjust terms as circumstances change. After your death, the trust becomes irrevocable and directs how property is distributed.

- Irrevocable Trust: Locks in the terms once created, which can provide stronger asset protection and potential tax benefits, but cannot be easily changed.

- Special Needs Trust: Provides long-term support for a child or adult with disabilities without affecting eligibility for government benefits.

- Pet Trust: This trust allows you to set aside funds and name a caretaker for animals after your death.

- Charitable Trust: Used to leave money or property to charitable organizations while sometimes providing tax benefits for your estate.

- Testamentary Trust: Created through a will and activated only after death. Because it is tied to a will, it does not avoid probate but can still provide structure for children or other beneficiaries.

Understanding the distinctions helps you and your trust and estate planning attorney select the trust that best fits your estate plan. Once the right type is chosen, the next step is creating and funding the trust so it can protect your property and provide for the people and causes you care about most.

Steps to Create a Trust in Virginia

Once you understand the types of trusts available, the next step is putting one into place. Creating a trust in Virginia involves several stages, and working with a trusts attorney ensures the process is legally sound and aligned with your goals. The key steps are:

- Identify your Goals: Decide what you want to accomplish—whether it’s providing for children, leaving money to a charity, protecting a family business, or caring for pets.

- Choose a Trustee: Select a person or institution you trust to manage assets and carry out the terms of the trust.

- Draft the Documents: Your attorney prepares the legal documents required under Virginia Code Title 64.2.

- Fund the Trust: Retitle property, accounts, and other assets in the name of the trust. This step is critical—without funding, the trust cannot do its job.

- Review and Update: Life changes, and so should your trust. Marriage, divorce, new children or grandchildren, or the purchase of property may all require updates.

Taking these steps turns the idea of a trust into a working part of your estate plan. Once created and properly funded, the trust can manage your assets, reduce probate, and provide security for your family.

The Role of a Trustee

Since choosing a trustee is one of the most important steps in creating a trust, it helps to understand exactly what this role involves. In Virginia, trustees carry a fiduciary duty, meaning they must act in the best interests of the beneficiaries and follow the terms of the trust. Their responsibilities may include:

- Managing property and financial accounts placed in the trust.

- Paying bills, debts, and taxes.

- Keeping accurate records of transactions and providing reports to beneficiaries.

- Distributing money or property according to the instructions you created.

A reliable trustee can handle responsibilities smoothly, but the wrong choice may create problems such as family conflict, mismanagement of funds, or delays in distribution. Some people prefer to appoint a professional or corporate trustee when estates are large or involve business interests, while others feel confident naming a trusted family member or friend.

By making this decision carefully, you help protect your estate and keep the focus on carrying out your plan rather than resolving disputes.

Common Mistakes to Avoid

Choosing the wrong trustee is one of the most common mistakes people make when setting up a trust, but it’s not the only one. Even a well-drafted trust can fall short if important details are overlooked. Some frequent pitfalls include:

- Failing to Fund the Trust: A trust only controls the property transferred into it. If assets remain outside, they may still go through probate.

- Relying on Generic Online Forms: Documents that don’t follow Virginia law may not hold up when your family needs them most.

- Overlooking Tax and Business Issues: Larger estates or small business interests often require special planning to avoid legal complications.

- Neglecting Updates: Life events such as marriage, divorce, or the birth of children can make an old trust outdated.

Avoiding these mistakes strengthens your estate plan and spares your loved ones unnecessary stress. With the right legal guidance, you can create a trust that does exactly what it was designed to do—protect your assets and provide for your family.

Protect Your Family and Future with a Thoughtfully Crafted Trust

Creating a trust is about more than signing documents. It’s about protecting your family from probate, safeguarding privacy, providing for children and even pets, and making sure your assets are managed the way you intended. At PJI Law, PLC, we work closely with families in Fairfax County and throughout Northern Virginia to design trusts that reflect your goals, avoid common mistakes, and give you peace of mind for the future.

When you meet with us, we’ll take the time to understand your estate, your priorities, and the people who matter most. From choosing the right type of trust to funding it properly and selecting a trustee you can rely on, we guide you through every step of the process.

Call PJI Law at (703) 865-6100(703) 865-6100 or contact us online to schedule a complimentary, confidential estate planning consultation with an estate planning lawyer. Together, we’ll create a trust that protects your property, provides for your loved ones, and carries out your vision for the future.

At PJI Law, you’ll receive white glove service and personal attention from a team that treats you like family.

Copyright © 2025. PJI Law, PLC. All rights reserved.

The information in this blog post (“post”) is provided for general informational purposes only and may not reflect the current law in your jurisdiction. No information in this post should be construed as legal advice from the individual author or the law firm, nor is it intended to be a substitute for legal counsel on any subject matter. No reader of this post should act or refrain from acting based on any information included in or accessible through this post without seeking the appropriate legal or other professional advice on the particular facts and circumstances at issue from a lawyer licensed in the recipient’s state, country, or other appropriate licensing jurisdiction.

PJI Law, PLC

3900 Jermantown Road, #220

Fairfax, VA 22030

(703) 865-6100(703) 865-6100

https://www.pjilaw.com

Tell Us What Happened

Call Now: (703) 865-6100(703) 865-6100

* Required Fields

By contacting PJI Law, PLC by any means, you agree that you are not forming an attorney-client relationship. You agree that any information you provide may not remain confidential nor be protected by the attorney-client privilege. Before we can represent you, we have to ensure that there are no conflicts of interest; therefore, do not share any confidential information, and/or information that could harm you if revealed to another party in your matter, until you have entered into a written agreement with us. An attorney-client relationship cannot be formed without a written agreement signed by PJI Law, PLC.