Steps for Probating a Will in Virginia

Probating a will in Richmond, VA, can be an intimidating process when you’re grieving the loss of a loved one. The legal and financial responsibilities involved require careful attention to detail because every aspect must comply with Virginia laws. If you have been named the executor of an estate, understanding the probate and estate administration process will help you fulfill your duties effectively.

This blog, from a probate and estate administration law firm, explains probating a will in Virginia and simplifies probate for personal representatives. Whether you are managing probate or estate administration for the first time or encountering complexities along the way, this blog offers clarity and support to help you execute your responsibilities with confidence.

Probate Law Explained

Probate is a court process through which a personal representative, also known as an executor or administrator, settles a deceased person’s estate. During probate, the court validates the will and oversees the payment of debts and the distribution of assets to beneficiaries according to the deceased’s wishes or, if there is no will, in accordance with Virginia’s intestate succession laws. This legal process occurs in the Circuit Court for the county or city where the deceased resided.

By understanding the steps involved in probate administration, you can reduce delays while fulfilling your fiduciary obligations with diligence.

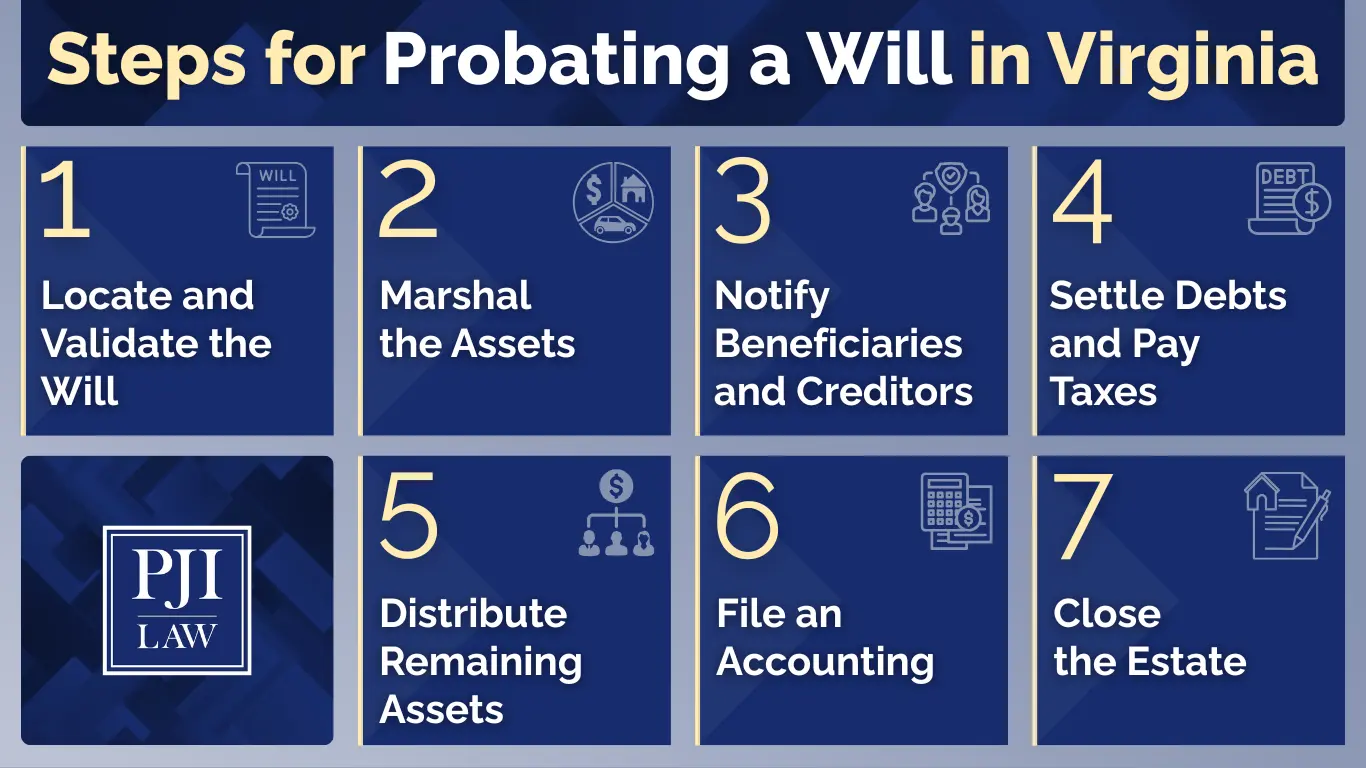

Step 1: Locate and Validate the Will

As knowledgeable probate lawyers will tell you, the first job in probate is locating the deceased’s will and taking it to the Circuit Court in the appropriate jurisdiction for validation.

Actions to Take

- Locate the Will: Search for the original will and other estate planning documents, which may be stored in a safe deposit box, with a lawyer, or among the deceased’s personal papers.

- File the Will with the Clerk of the Circuit Court: Take the original will and file it with the Clerk’s Office in the jurisdiction where the decedent resided.

- Obtain the Certificate of Qualification: This document officially appoints you as the executor and grants you the legal authority to act on behalf of the estate.

If there is no will, probate proceeds under Virginia’s intestate succession laws, which determine the distribution of assets among surviving family members.

Step 2: Marshal the Assets

Marshalling the assets refers to the process of identifying, securing, and documenting every asset the deceased owned to account for all estate property before paying debts and distributing assets.

Responsibilities of the Personal Representative

- Identify All Assets: Take inventory of the deceased’s belongings, including real estate, bank accounts, investment accounts, vehicles, valuables, and digital assets.

- Secure the Property: Protect the assets by notifying financial institutions of the decedent’s passing, safeguarding valuables, and securing real estate by changing locks if necessary.

- Conduct Appraisals: Obtain appraisals for items like real estate, art, or jewelry to determine their fair market value.

- File an Inventory with the Commissioner of Accounts: Virginia law requires the personal representative to submit a detailed inventory of the estate’s assets to the Commissioner of Accounts within four months of qualification.

Proper marshalling upholds transparency and accountability while creating a thorough record of the estate’s financial position.

Step 3: Notify Beneficiaries and Creditors

To maintain transparency and comply with legal obligations, the personal representative must notify beneficiaries and creditors of the decedent’s passing.

Required Notifications

- Beneficiaries: Send written notice to all of the decedent’s heirs-at-law and all individuals named in the will. Inform them of their entitlements and keep them updated throughout the probate process.

- Creditors: Publish a notice of death in a local newspaper to inform creditors and provide them the opportunity to file claims against the estate.

Under Virginia law, creditors must file claims within a specified window, typically six months. Failure to notify beneficiaries or creditors can result in legal disputes or delays.

Step 4: Settle Debts and Pay Taxes

Before distributing assets, the personal representative must resolve outstanding debts and taxes associated with the estate.

Steps to Settle Financial Obligations

- Address Final Expenses: Cover administrative costs for settling the estate and pay final expenses, which may include funeral expenses and medical bills related to the decedent’s last illness.

- Review and Verify Claims: Assess claims submitted by creditors for validity, and pay only legitimate claims in order of their priority. Paying claims out of order can expose you to personal liability.

- File Final Taxes: Work with a tax professional to file the deceased’s personal income tax returns, as well as estate income tax or federal estate tax filings, if applicable.

- Pay Taxes: Use the estate’s funds to pay any outstanding taxes at both the state and federal levels.

Virginia does not impose an estate tax, but federal estate taxes may apply to high-value estates. Settling financial obligations puts the estate in good standing before moving forward with asset distribution.

Step 5: Distribute Remaining Assets

Once the personal representative pays debts and taxes, they can distribute the remaining assets to the beneficiaries according to the terms of the will.

Asset Distribution Process

- Follow the Will’s Instructions: Review the specific bequests and give each beneficiary the correct share or item.

- Provide Receipts of Distribution: Request beneficiaries to sign acknowledgment receipts upon receiving their inheritance.

- Handle Intestacy If Necessary: If no will exists, distribute assets according to Virginia’s intestacy laws, which prioritize the surviving spouse, children, and other close relatives.

Distributing assets accurately and systematically helps avoid disputes and fulfills your legal obligation to the estate.

Step 6: File an Accounting

Virginia law requires a personal representative to file periodic accountings with the Commissioner of Accounts during the probate process to document all income, expenditures, and distributions related to the estate.

Key Actions

- Maintain detailed records of financial transactions associated with the estate.

- Submit copies of receipts, paid bills, and distribution summaries with the accounting report.

- Respond to any inquiries from the Commissioner of Accounts.

Working with an experienced probate attorney will help you stay organized, meet filing deadlines, and handle probate smoothly with reduced complications.

Step 7: Close the Estate

The final step in probate is to close the estate and obtain court approval for completing your responsibilities as a personal representative.

Closing Actions

- File the Final Accounting: Submit a complete summary of all estate activities to the Commissioner of Accounts.

- Pay Remaining Fees: Cover any outstanding court fees, bond premiums, or administrative costs.

- Distribute Remaining Funds: Allocate any funds left in the estate account after closing to beneficiaries.

Once the court reviews and approves your final accounting, it officially closes the estate and absolves you of your duties as a personal representative.

Why Do I Need Legal Representation?

Due to the complexities of probate, it’s easy to make mistakes that can result in delays, legal disputes, or personal liability. Partnering with an experienced probate attorney can help you avoid pitfalls and facilitate an efficient process.

How PJI Law Simplifies Probate

At PJI Law in Richmond, VA, our experienced probate lawyers provide comprehensive guidance for personal representatives managing estates. From marshaling assets to settling debts and filing court documents, we meet every legal requirement.

By working with PJI Law, you gain access to legal knowledge and personalized support tailored to your estate’s unique circumstances. Our compassionate legal team eases your burden, allowing you to focus on honoring your loved one’s legacy.

A Probate Attorney in Richmond, VA, Answers Frequently Asked Questions About Estate Administration

What does an estate administration attorney in Richmond, VA do?

An estate administration attorney in Richmond, VA, guides clients through the legal process of managing and settling an estate after someone passes away. This effort can include filing documents in probate court, addressing fiduciary litigation, and allocating the estate’s assets according to the deceased’s wishes. An attorney also provides individualized service to help clients understand and manage any probate issues that arise, particularly in complex cases involving numerous heirs or disputes.

What is probate, and can you avoid it?

Probate is the legal process of verifying a deceased person’s will and distributing their assets to the appropriate heirs. While probate legally enforces the decedent’s wishes, it can be a lengthy and sometimes costly process. Fortunately, there are ways to avoid probate in certain situations. A knowledgeable Virginia estate planning attorney develops legal strategies, such as establishing trusts, naming beneficiaries directly on accounts, or holding property jointly. For clients in the Richmond area, working with a Virginia estate planning law firm can help safeguard their hard-earned assets from unnecessary legal hurdles.

How does estate planning help prevent probate issues?

Estate planning minimizes complications that might arise during probate. By clearly outlining your wishes in legally sound documents, such as wills and trusts, you reduce the chances of disputes among heirs. Estate planning attorneys draft and review these documents periodically to keep them current with changes in your life or the law. This proactive approach protects your assets and eases the burden on your loved ones.

What are common challenges in estate administration?

Estate administration often involves resolving disputes, particularly when multiple heirs have differing opinions. Fiduciary litigation might occur if one party believes the personal representative or trustee (in the case of trust administration) has mishandled the estate. Other common issues include locating all assets, settling outstanding debts, and understanding complex tax obligations. An experienced estate administration attorney can streamline this process by addressing these challenges efficiently and advocating for their clients.

Why is individualized service important in estate administration?

Every estate is unique, and so are the needs of the heirs and personal representatives involved. A Virginia attorney who offers individualized service can tailor their approach to the specific concerns of their clients. For example, moving through the probate system in and around Richmond, VA, requires an understanding of Virginia’s unique estate and probate laws. By offering personalized guidance, an estate administration attorney supports their clients through the conclusion of probate.

Can an attorney help resolve disputes among heirs?

A probate attorney helps resolve inheritance disputes. Whether conflicts arise over asset distribution, the validity of a will, or the conduct of a personal representative, these issues can often escalate into fiduciary litigation. A skilled estate administration attorney acts as a legal advisor and a negotiator to help lessen tensions and work toward equitable solutions. This approach protects family relationships while securing the client’s interests.

Who should consider hiring an estate administration attorney?

Anyone tasked with managing a loved one’s estate should consider working with an attorney. Retaining a legal team in Virginia is particularly important if the estate contains significant assets, if someone contests the will, or if multiple heirs exist. Additionally, individuals seeking to organize their own affairs can benefit from consulting a Virginia estate planning law firm to avoid probate and honor their wishes. Whether you’re in the Richmond area or elsewhere in Virginia, hiring a knowledgeable attorney is an investment in protecting your legacy and giving your family peace of mind.

Contact PJI Law in Richmond, Virginia for Personalized Service & Attention

Probating a will may feel like an overwhelming responsibility, but by breaking the process into clear steps, you can manage your executor duties effectively. Remember to locate and validate the will, marshal assets, notify all parties, settle debts, distribute assets, and file accountings before closing the estate.

Have you been searching online for an “estate administration law firm,” “probate administration lawyers,” or “probate law firms near me?”

Reach out to PJI Law in Richmond, Virginia, for personalized service and attention. Our practice areas include estate planning, probate, business succession planning, and trust administration. Our extensive experience in contested matters and all aspects of probate in Virginia allows us to shoulder the burden of estate administration and ease your mind during a difficult time. And if you’re ready to start estate planning, you can trust our legal experience and personal service to establish a comprehensive plan based on your unique circumstances and goals.

Call us at (804) 653-3450(804) 653-3450 or complete our online form to schedule a consultation today. With PJI Law in Richmond, Virginia, by your side, you can confidently fulfill your responsibilities and complete the probate process with care and precision.

Copyright © 2025. PJI Law, PLC. All rights reserved.

The information in this blog post (“post”) is provided for general informational purposes only and may not reflect the current law in your jurisdiction. No information in this post should be construed as legal advice from the individual author or the law firm, nor is it intended to be a substitute for legal counsel on any subject matter. No reader of this post should act or refrain from acting based on any information included in or accessible through this post without seeking the appropriate legal or other professional advice on the particular facts and circumstances at issue from a lawyer licensed in the recipient’s state, country, or other appropriate licensing jurisdiction.

PJI Law, PLC

4108 E Parham Rd,

Richmond, VA 23228

(804) 653-3450(804) 653-3450

https://www.pjilaw.com/

Tell Us What Happened

Call Now: (804) 653-3450(804) 653-3450

* Required Fields

By contacting PJI Law, PLC by any means, you agree that you are not forming an attorney-client relationship. You agree that any information you provide may not remain confidential nor be protected by the attorney-client privilege. Before we can represent you, we have to ensure that there are no conflicts of interest; therefore, do not share any confidential information, and/or information that could harm you if revealed to another party in your matter, until you have entered into a written agreement with us. An attorney-client relationship cannot be formed without a written agreement signed by PJI Law, PLC.