What Are the Steps to Placing Your House in a Trust in Virginia?

Placing your house in a trust can be one of the most meaningful decisions you make for your family. It’s not just about asset protection or avoiding probate—it’s about peace of mind. You want to know your home will go to the right people, at the right time, without unnecessary court involvement or confusion. At PJI Law, we understand how personal this process is. Many of our clients have built their lives in the same home for decades. For them, placing a house in a trust isn’t just a financial move; it’s an act of love.

Whether you’re planning for long-term goals, protecting a vulnerable family member, or simply preparing for the future, it helps to know what the process involves. Below, we explain the legal steps to place your house in a trust in Virginia, what decisions you’ll need to make, and how to avoid common pitfalls.

Before you commit to the process, it’s worth understanding what you’ll gain and what challenges may come with it.

Benefits of Putting Your House in a Trust

Placing your house in a trust can do more than just simplify what happens after you’re gone. It can also reduce stress for your family and give you greater peace about the future.

Here are a few specific benefits:

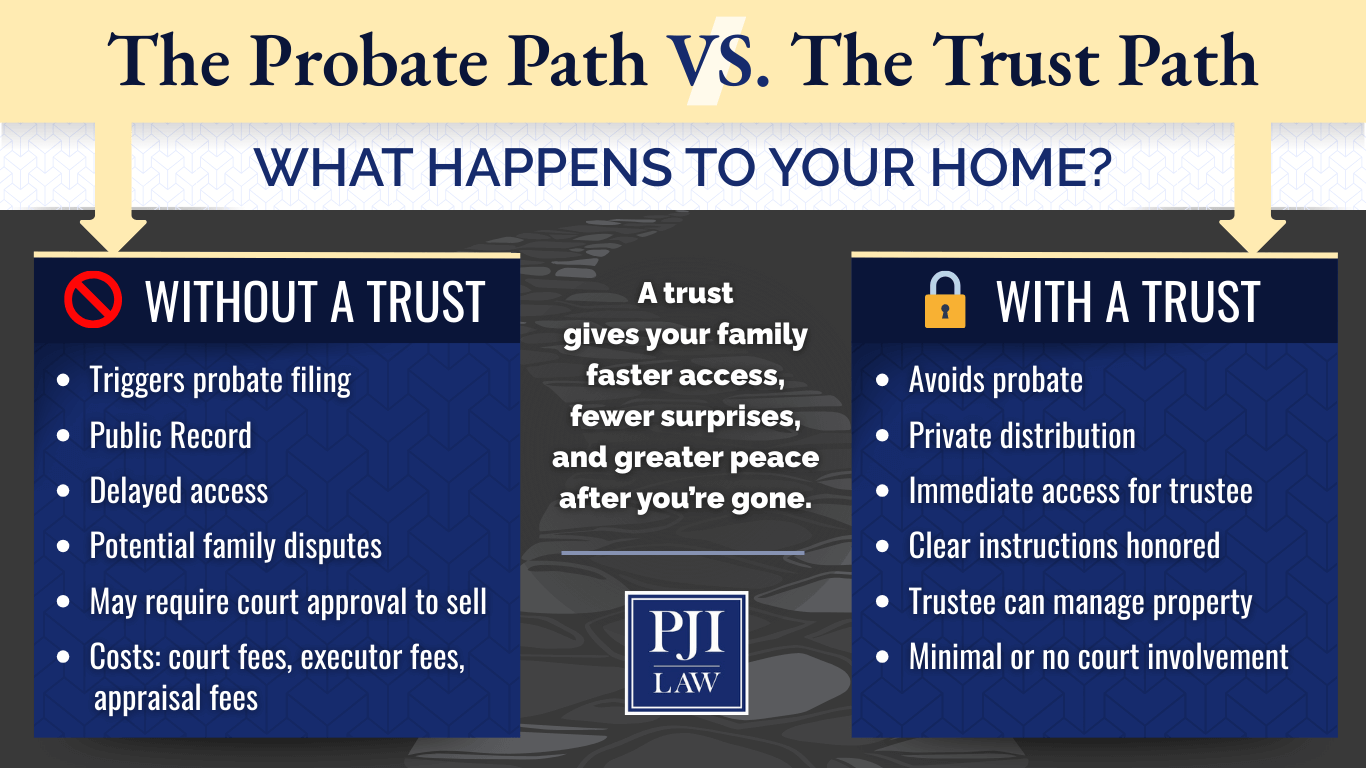

- Fewer delays for your loved ones. A properly funded trust lets your successor trustee take control without going through the probate court, which means no waiting for a judge to authorize basic tasks like paying the mortgage or selling the home.

- Clear direction for blended or complex families. If you’ve remarried, have stepchildren, or want to keep inherited property in the bloodline, a trust makes your wishes legally enforceable without relying on someone else’s memory or promises.

- Private handling of family matters. Unlike a will, which becomes public once filed, a trust remains confidential. That means no one outside the family needs to know who inherits the home or under what conditions.

- Continuity during incapacity. If you become unable to manage your affairs, your trustee can step in immediately to handle household needs, sell the property if necessary, or manage rental income without delay.

- Flexibility in how and when assets are passed down. You can keep the house in trust for a minor child, delay distribution until a certain age, or use the home for a surviving spouse with other terms in place after they pass.

Even with these benefits, a trust may not be the right solution for every homeowner. Here are a few trade-offs to consider before moving forward.

Considerations and What a Trust Does Not Provide

While a trust can offer many long-term advantages, it’s not always the right move for everyone. It’s important to consider the trade-offs to understand what you’re taking on.

Here are some potential items to consider:

- Upfront effort and cost. You’ll need to create a trust document, prepare a new deed, and file it with the county. This often involves attorney fees and some administrative legwork.

- Ongoing responsibility. You will want to keep the trust updated if you refinance your move or make changes to your estate plan. If you forget to title inherited or newly purchased property into the trust, it won’t be protected.

- Not a shield from creditors. With a revocable trust, your assets, including your home, are still considered legally yours. That means they remain vulnerable to legitimate lawsuits, liens, or collections during your lifetime.

- Title complications if poorly drafted. Mistakes in the deed or trust language can create issues with title companies when it’s time to refinance or sell. This is why DIY documents are strongly discouraged. They often cause more problems than they solve.

- No direct tax savings. A revocable trust doesn’t change how your property is taxed while you’re alive. It still appears under your Social Security number, and you’re responsible for any property or income taxes just as before.

If you’ve weighed the benefits and considered the trade-offs and decided a trust makes sense for your situation, the next step is to understand how the process works in Virginia.

Step 1: Choose the Right Type of Trust for Your Goals

Before transferring your home into a trust, you’ll need to decide what kind of trust fits your needs. In Virginia, the most common types include:

- Revocable living trusts. These are flexible and can be changed or revoked during your lifetime. You typically serve as your own trustee and retain full control over the property.

- Irrevocable trusts. Once you place your house in this type of trust, you give up control over it. These trusts may offer greater protection from creditors and certain tax advantages.

- Testamentary trusts. Created by your will and go into effect after your death. Your house remains in your name until then.

- Special needs trusts. Used to leave property for a loved one with a disability without affecting their eligibility for benefits.

- Charitable trusts. Allow you to leave your home or its value to a nonprofit organization.

The type of trust you choose will affect how your property is treated for tax, control, and probate purposes. A revocable trust is often the most practical choice for Virginia homeowners who want to keep managing their home while simplifying what happens after death.

Step 2: Select the Right Trustee

The trustee is the person or entity responsible for managing the trust. If you’re creating a revocable trust, you can serve as your own trustee while naming a successor trustee to take over when you pass away or become incapacitated. This gives you full control during your lifetime.

When choosing a trustee, think about:

- Who is trustworthy, organized, and willing to follow your instructions?

- Who understands your family dynamics?

- If your trust will continue after your death (such as for minor children or loved ones with special needs), who is equipped to manage long-term property decisions?

Your trustee should be someone you would trust to carry out your wishes with care and attention.

Step 3: Create the Trust Document

Once you’ve selected the trust type and trustee, your next step is drafting the actual trust document. This legal document names:

- The trust creator (you)

- The trustee (who is responsible for managing the trust assets)

- The beneficiaries (who will inherit the home or live in it)

- The terms and conditions of the trust

Your trust document must comply with Virginia law to be valid. Inaccuracies, vague language, or missing provisions can cause confusion, delay access to trust property, or lead to disputes. This is why working with a knowledgeable Virginia trusts attorney matters. A DIY template might not cover everything, especially when you’re dealing with valuable real estate, complex family dynamics, or blended families.

At PJI Law, we tailor each trust to reflect your values, your property, and your long-term goals.

Step 4: Sign and Notarize the Trust

Once your trust is drafted, you’ll sign it in front of a notary public. This step makes the trust legally valid. While notarization is not strictly required for all revocable trusts in Virginia, it is strongly recommended to help prove authenticity and avoid challenges later on.

Step 5: Transfer or Fund the House into the Trust

Creating the trust isn’t enough. You must formally move the house into the trust by filing a new deed. This is called funding the trust.

Here’s how it works:

- Prepare a new deed transferring ownership from your name to the trust, either immediately or upon your death.

- For example: “John A. Smith hereby conveys to John A. Smith, Trustee of the Smith Family Trust dated July 1, 2025…”

- Sign the deed in front of a notary.

- File the deed with the land records office in the circuit court of the county where the property is located. For example, if your home is in Fairfax County, you’ll file with the Fairfax Circuit Court.

Until this step is complete, your house is not legally part of the trust. That means it would still require involvement by the probate court unless properly transferred.

Once your home is legally transferred into the trust, there are a few important housekeeping tasks to complete so nothing falls through the cracks.

Step 6: Update Homeowners Insurance

Once the trust owns your home, you’ll need to notify your homeowners insurance provider to add your trust as an additional insured party.

If your home has a mortgage, placing a home in a revocable trust will not trigger the due-on-sale clause, thanks to protections under the federal Garn-St. Germain Act (12 U.S.C. § 1701j-3(d)(8)).

Step 7: Keep the Trust Document Safe and Up to Date

Once your home is in the trust, keep a copy of the trust document in a secure but accessible location. Let your successor trustee know where to find it. If you move, refinance, or make major changes to your estate plan, revisit the trust to make sure it still reflects your wishes.

Creating a trust is not a set it and forget it task. It’s part of a larger estate plan that may include your will, powers of attorney, health care directives, and other important documents. Over time, your goals, relationships, or property may change. When they do, your trust should be reviewed and updated accordingly.

Many Virginia homeowners also ask what kind of flexibility they’ll have after the trust is created, especially when it comes to refinancing or selling.

Can You Still Sell or Refinance a House in a Revocable Trust?

Yes. If you’ve placed your home in a revocable living trust and named yourself as trustee, you can still sell, rent, or refinance the property. You retain full control during your lifetime.

That said, your title company or lender may request a certification of trust or a copy of the trust showing your authority. In some cases, you may need to temporarily deed the home back into your individual name before completing a sale or refinance.

Your home may also play a role in broader planning goals beyond your immediate heirs.

What About a Pet Trust or Family Business?

If you plan to pass on a family business or leave money for the care of a pet, your home might still play a role in that plan. You could:

- Include provisions in your trust to allow the property to be sold and the proceeds distributed to support a charitable trust or special needs trust.

- Leave the house to a designated caretaker to continue caring for pets who remain in the home.

- Use rental income from a second property to fund long-term goals for your children or grandchildren.

Note: In Virginia, pet trusts end when no covered pets remain, and any leftover funds are distributed according to the trust or default rules.

Still have questions about how this all works in practice? Below are answers to some of the most common questions we hear from families across Northern Virginia.

Frequently Asked Questions

Q: Can I name different beneficiaries for my home and my other assets?

A: Yes. Your trust can designate one beneficiary to receive your home and others to receive different property, like bank accounts or investments. Each asset can be handled individually, giving you full control over how your estate is distributed.

Q: Does placing my home in a trust protect it from creditors?

A: Not if it’s a revocable trust. During your lifetime, assets in a revocable trust are still considered your property and remain accessible to creditors. If protection from creditors is your goal, you would need to speak with your attorney about an irrevocable trust and how that might impact access, control, and Medicaid planning.

Q: Can I remove my house from the trust later if I change my mind?

A: Yes, if the trust is revocable. You can amend or revoke the trust at any time, including transferring the home back into your name. This flexibility is one of the reasons revocable living trusts are so common in Virginia estate planning.

Q: Will my property taxes change if I transfer my house to a trust?

A: In most cases, no. Virginia law does not impose additional property tax just because a home is placed in a revocable trust. The property remains eligible for standard tax rates and exemptions, including senior or disability-related property tax relief, as long as the trust is structured properly.

Q: Can I name someone out of state as my trustee?

Yes, you can. Virginia does not require your trustee to live in the Commonwealth. However, naming an out-of-state trustee can complicate real estate transactions or communications with local institutions. It’s worth considering whether a local trustee or at least a co-trustee in Virginia might make things easier for your family.

Talk with a Trusts Attorney in Northern Virginia Who Treats Your Family Like Their Own

At PJI Law, our team works with families throughout Fairfax County and Northern Virginia who want more than just documents. We take time to understand your needs, answer your questions, and build legally sound trusts that reflect what matters most—your family, your home, and your future.

Your online search for “attorney for estate planning near me” or “attorney for trust” brought you here. Now it’s time to protect what matters.

Call PJI Law at (804) 653-3450(804) 653-3450 or contact us online to schedule your confidential estate planning consultation. We’ll guide you through the process of placing your house in a trust and give you the support you need to create peace for those you love most.

At PJI Law, you’ll receive white glove service and personal attention from a team that treats you like family.

Copyright © 2025. PJI Law, PLC. All rights reserved.

The information in this blog post (“post”) is provided for general informational purposes only and may not reflect the current law in your jurisdiction. No information in this post should be construed as legal advice from the individual author or the law firm, nor is it intended to be a substitute for legal counsel on any subject matter. No reader of this post should act or refrain from acting based on any information included in or accessible through this post without seeking the appropriate legal or other professional advice on the particular facts and circumstances at issue from a lawyer licensed in the recipient’s state, country, or other appropriate licensing jurisdiction.

PJI Law, PLC

3900 Jermantown Road, #220

Fairfax, VA 22030

(804) 653-3450(804) 653-3450

https://www.pjilaw.com

Tell Us What Happened

Call Now: (804) 653-3450(804) 653-3450

* Required Fields

By contacting PJI Law, PLC by any means, you agree that you are not forming an attorney-client relationship. You agree that any information you provide may not remain confidential nor be protected by the attorney-client privilege. Before we can represent you, we have to ensure that there are no conflicts of interest; therefore, do not share any confidential information, and/or information that could harm you if revealed to another party in your matter, until you have entered into a written agreement with us. An attorney-client relationship cannot be formed without a written agreement signed by PJI Law, PLC.