What is a Virginia Special Needs Trust?

Estate planning helps preserve your assets and protects your loved ones after you pass away. However, when aging loved ones or other family members have special needs, designing the right plan for their future well-being becomes even more urgent.

One of the most effective tools for individuals for this purpose is a Virginia special needs trust (SNT), which protects a disabled individual’s financial future without jeopardizing their eligibility for public benefits, like Supplemental Security Income (SSI) and Medicaid.

This comprehensive blog explains the essentials of a Special Needs Trust, its unique benefits, and how it operates in Virginia. Whether you’re a parent of a child with a disability or a family member planning for a loved one’s care, we’ll clarify the purpose of these trusts and answer common questions about other trusts in Virginia.

What is an SNT?

An SNT, or Special Needs Trust, specifically supports individuals with disabilities. Its main purpose is to hold and manage assets for the person’s benefit while keeping them eligible for federal and state assistance programs. Without proper planning, inheriting assets could inadvertently disqualify your loved one from accessing the public benefits they rely on for medical care and living expenses.

This type of trust prevents this problem by separating the assets from the person’s direct ownership. A trustee manages the funds in the trust and uses them to cover expenses that improve the beneficiary’s quality of life, which could include costs for caregivers, education, therapies, or even recreational activities—expenses that public benefits don’t cover.

An Estate Planning Attorney Explains the Benefits of an SNT

- Maintains Eligibility for Public Benefits

Public assistance programs, such as Medicaid and SSI, have strict income and asset limits. An SNT prevents funds meant for the beneficiary from counting toward these limits, allowing continued access to such benefits. - Enhanced Quality of Life

The assets held in an SNT can be used for services or items that improve the beneficiary’s living conditions. For example, funds can cover educational programs, healthcare not provided by Medicaid, transportation, or technology such as assistive devices. - Protection from Creditors

Because the assets belong to the trust rather than the individual, they’re protected from claims made by creditors or liability settlements. - Long-Term Estate Planning

These trusts provide continuity and financial security beyond the lifetime of a caregiver or parent, relieving families’ concerns about the future. - Tailored Support

You can customize SNTs to meet your unique needs and specifically outline the use and distribution of funds. - Privacy

Assets held in an SNT do not go through probate, keeping financial and personal matters private.

Creating an SNT in Richmond, Virginia

Establishing a Special Needs Trust involves careful planning and legal guidance from knowledgeable and experienced attorneys.

1. Determine Trust Goals

Start by evaluating your intentions. Are you trying to safeguard eligibility for public benefits, protect assets, or create a reserve fund for specific needs? Clear goals will help your attorneys structure the trust appropriately.

2. Choose a Trustee

The trustee holds significant responsibility, as they’ll manage the funds and distribute the funds properly, according to the trust’s terms. Trustees can be family members, independent professionals, or financial institutions with extensive knowledge in trust administration.

3. Draft the Trust Document

A trust document outlines the terms of the trust, including how to distribute funds and what expenses the trust allows. This legal document should comply with state and federal regulations, especially concerning public benefits programs.

4. Fund the Trust

Once established, the trust creator must transfer assets into it, such as cash, investments, property, or life insurance policies.

5. Maintain Compliance and Oversight

Trustees must align distributions with the trust’s terms and prevent funds from inadvertently disqualifying the beneficiary from receiving public benefits. Detailed record-keeping and regular reviews assist in this process.

6. Work with an Experienced Attorney

Guidance from a Virginia estate planning attorney serves to make sure the SNT complies with state and federal laws. An attorney can also offer advice tailored to your family’s unique needs.

Frequently Asked Questions About SNTs and Other Trusts in Virginia

What expenses can an SNT cover?

The funds in an SNT can cover a variety of expenses that enhance the beneficiary’s quality of life, including medical care, therapy, educational programs, transportation, and recreational activities. However, as a lawyer will advise, the trustee must obey the rules associated with public benefits.

Can an SNT own property on behalf of the beneficiary?

An SNT can own property such as a home or a vehicle. However, properties owned by the trust should be for the beneficiary’s use and aligned with the trust’s goals.

How does an SNT differ from other types of trusts?

While many trusts focus on minimizing taxes, protecting assets, or avoiding probate, an SNT specifically preserves eligibility for public assistance programs while providing supplemental support.

What is the role of a trustee in managing an SNT?

The trustee manages the trust assets and distributes funds according to the trust’s terms. It requires a strong understanding of financial management and public benefits regulations. Trustees must act in the beneficiary’s best interests and keep accurate records.

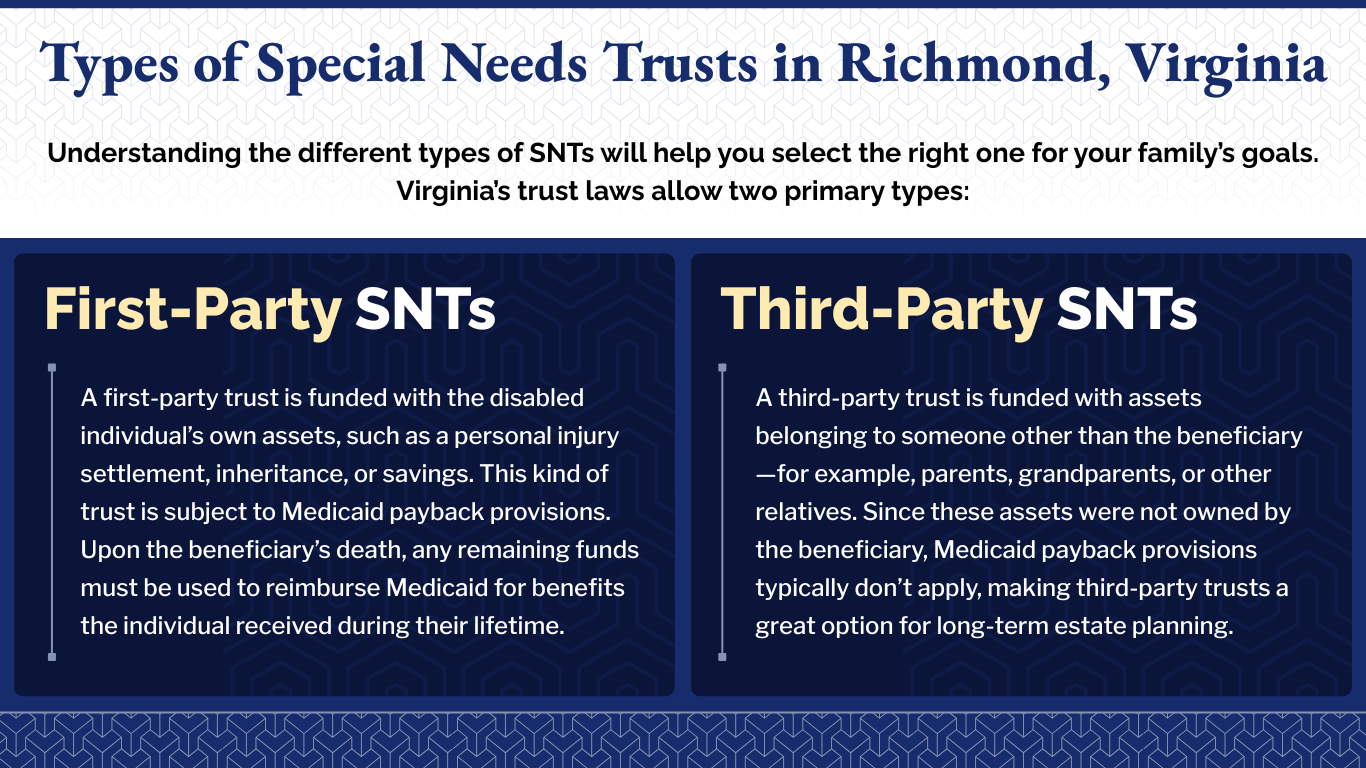

Can an SNT be altered or revoked?

The ability to revoke or modify an SNT depends on the type of trust. Generally, third-party special needs trusts can be more flexible, while first-party trusts may have stricter rules. Consulting an attorney can clarify the options available.

Are there tax implications for an SNT?

Taxation depends on the trust type and distribution methods. Typically, the trust’s income is taxed at trust rates unless specifically distributed to the beneficiary. Consulting a lawyer is advisable for proper planning.

Secure Your Loved One’s Future with PJI Law in Richmond, Virginia

SNTs provide peace of mind and procure the ongoing care of loved ones with disabilities. However, creating one involves thoughtful consideration of multiple legal, financial, and personal factors. Collaborating with an experienced Virginia estate planning attorney, like the team at PJI Law, structures the SNT correctly so it can serve its intended purpose.

At PJI Law, we help our clients create tailored estate planning solutions, including SNTs, to meet the unique needs of their families. Our practice areas include wills, trusts, trust administration, probate administration for an executor/personal representative tasked with estate administration, and much more.

Contact us at (703) 865-6100(703) 865-6100 or complete our online form to schedule a consultation. Together, we’ll protect your loved one’s future and provide the support they need to thrive.

Copyright © 2025. PJI Law, PLC. All rights reserved.

The information in this blog post (“post”) is provided for general informational purposes only and may not reflect the current law in your jurisdiction. No information in this post should be construed as legal advice from the individual author or the law firm, nor is it intended to be a substitute for legal counsel on any subject matter. No reader of this post should act or refrain from acting based on any information included in or accessible through this post without seeking the appropriate legal or other professional advice on the particular facts and circumstances at issue from a lawyer licensed in the recipient’s state, country, or other appropriate licensing jurisdiction.

PJI Law, PLC

4108 E Parham Rd,

Richmond, VA 23228

(703) 865-6100(703) 865-6100

https://www.pjilaw.com/

Tell Us What Happened

Call Now: (703) 865-6100(703) 865-6100

* Required Fields

By contacting PJI Law, PLC by any means, you agree that you are not forming an attorney-client relationship. You agree that any information you provide may not remain confidential nor be protected by the attorney-client privilege. Before we can represent you, we have to ensure that there are no conflicts of interest; therefore, do not share any confidential information, and/or information that could harm you if revealed to another party in your matter, until you have entered into a written agreement with us. An attorney-client relationship cannot be formed without a written agreement signed by PJI Law, PLC.