Can an Executor of a Will Be a Beneficiary in Richmond, Virginia?

When a loved one dies, it is common for one person, often an adult child or trusted friend, to suddenly hold two roles at once: beneficiary and executor. If you are asking yourself, “Can an executor of a will be a beneficiary?” you may be worried that other family members will think you are taking advantage, that the courts might remove you, or that you could be personally responsible if something goes wrong with the probate process.

At PJI Law, our estate planning attorneys and probate administration lawyers regularly speak with clients in Richmond VA who feel overwhelmed by these exact concerns and want practical, Virginia-specific answers so they can honor their loved one’s wishes and move forward.

Can an Executor of a Will Be a Beneficiary in Richmond, Virginia?

Under Virginia law, an executor may also be a beneficiary of the same estate. There is no statute that prohibits a beneficiary from serving as executor, and in practice, Virginia wills frequently name a beneficiary, such as a surviving spouse, adult child, or close relative, as executor. However, having a beneficiary as the executor of a will can lead to some complicated implications that we will address below. Virginia courts focus not on the simple fact that the executor is a beneficiary, but on whether that executor is properly carrying out fiduciary duties in accordance with the will and the Virginia Code.

In other words, your role as beneficiary does not disqualify you from serving. What matters is how you act in that role: whether you follow the law, treat beneficiaries fairly, and handle estate administration properly.

Why So Many Executors Are Also Beneficiaries

In Virginia estate planning, testators (the people who sign wills) usually choose someone they trust deeply to serve as executor. Often, that is the same person who may become a recipient of a substantial share of the estate:

- A surviving spouse who needs to access joint and individual accounts

- An adult child who has been helping aging parents for years

- A sibling or close friend with financial experience

This is entirely consistent with Virginia estate planning practice and probate law. The executor is responsible for managing assets, paying debts and taxes, and distributing property to heirs and beneficiaries. It makes sense that a testator wants a trusted beneficiary to oversee these steps.

However, because the executor is also a beneficiary, emotions can run high. Other heirs may worry that the executor-beneficiary is “helping themselves first” or that the estate plan is being changed informally along the way. Those concerns can often be reduced, or avoided altogether, when the executor understands the legal responsibilities and follows a clear, documented process.

Key Legal Duties of an Executor in Virginia

In Virginia, an executor (also called a personal representative) has a fiduciary duty to the estate and to all beneficiaries, regardless of personal relationships or their own interests as a beneficiary. Several provisions in Title 64.2 of the Code of Virginia and local guidance from Commissioners of Accounts lay out these responsibilities.

Core responsibilities

An executor must:

- Qualify before the court: The executor typically qualifies at the Circuit Court for the city or county where the decedent resided, such as the Richmond Circuit Court. At qualification, the executor takes an oath to faithfully perform the duties of the office and may have to post a bond.

- Collect and manage estate assets: This includes bank accounts, investment accounts, real property, vehicles, business interests, and other assets. The executor must safeguard these assets, open an estate account, and avoid mixing estate funds with personal accounts.

- Give notice to heirs and beneficiaries: Within 30 days after qualification, the executor generally must give written notice of probate or qualification to heirs at law and beneficiaries, then file the required affidavit with the clerk and Commissioner of Accounts.

- Prepare inventories and accountings: Virginia requires a detailed inventory of estate assets within a specified timeframe (often four months) and periodic accountings showing receipts, disbursements, and distributions, which are reviewed by the local Commissioner of Accounts.

- Pay valid debts and taxes: The executor must identify and pay lawful debts of the estate and handle tax filings, including final income tax returns and any applicable estate or inheritance taxes. Paying a time-barred or invalid claim can expose the executor to personal liability.

- Distribute the remaining estate: Only after debts, costs, and taxes are handled does the executor distribute the remaining property according to the will. If the decedent died without a will, Virginia intestacy law controls who inherits.

Emphasizing High Fidelity and Good Faith as a Beneficiary-Excutor in Virginia

Virginia courts hold executors to a high fiduciary standard, requiring them to act with loyalty and impartiality toward all beneficiaries, not just themselves. Fiduciary duties require acting in good faith, fairly, and according to Virginia law when managing assets, evaluating debts, and dealing with beneficiaries.

As a beneficiary-executor, this means you cannot prioritize your own share, delay distributions to others without legal cause, or use estate assets for personal benefit outside of your role.

Is it a Conflict of Interest if the Executor is Also a Beneficiary?

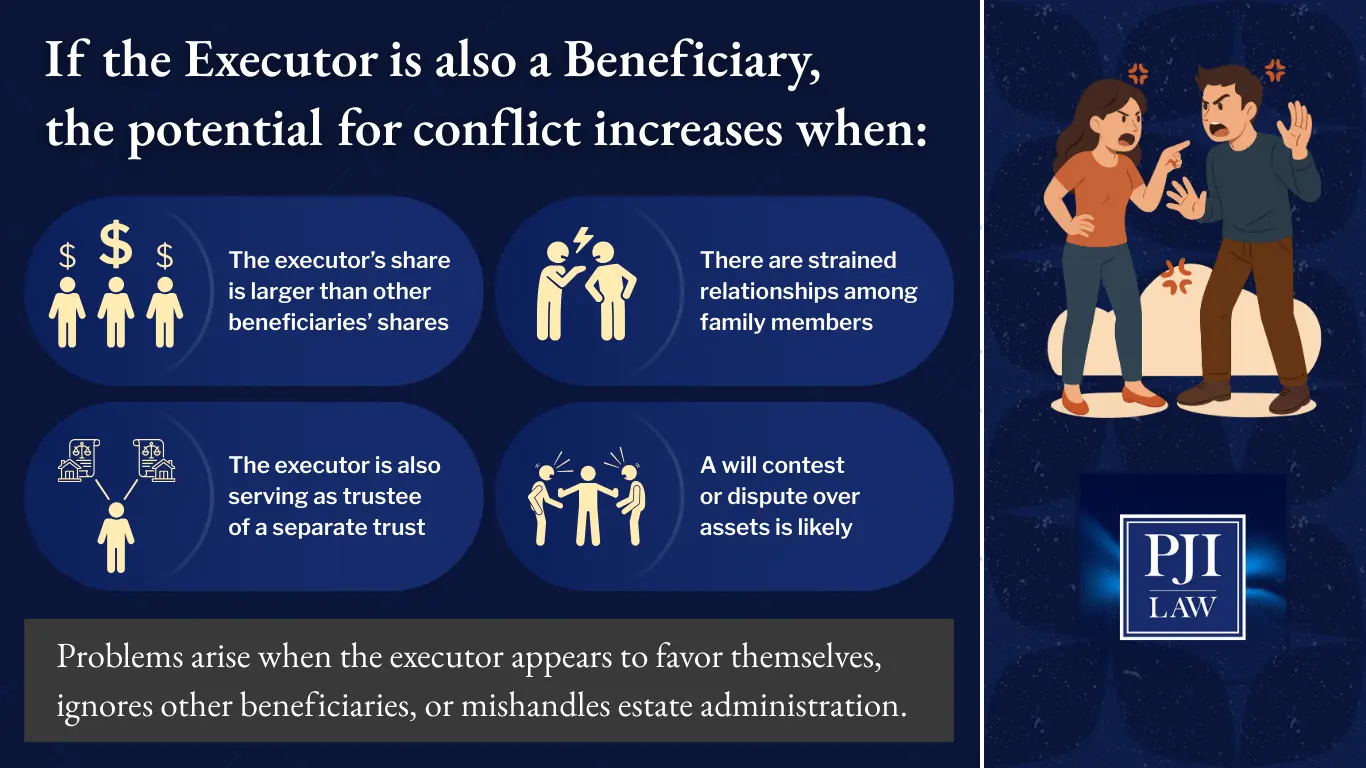

Simply being both executor and beneficiary is not, by itself, a legal conflict of interest under Virginia law. In fact, it is expected in many estates. However, the potential for conflict increases when:

- The executor’s share is larger than other beneficiaries’ shares

- There are strained relationships among family members

- The executor is also serving as trustee of a separate trust

- A will contest or dispute over assets is likely

Virginia ethics opinions recognize that when an attorney represents an executor who is also a beneficiary, the attorney’s client is the executor in the fiduciary role, not all beneficiaries. A conflict of interest may arise if the attorney tries to represent multiple beneficiaries with differing interests at the same time.

What matters practically is whether the executor is:

- Following the will and Virginia law

- Keeping accurate records

- Providing information when appropriate

- Seeking legal guidance when uncertain

If the executor is transparent and diligent, Virginia courts and Commissioners of Accounts typically accept the arrangement. Problems arise when the executor appears to favor themselves, ignores other beneficiaries, or mishandles estate administration.

Common Pain Points for Executor-Beneficiaries in Richmond, VA

If you are serving as both executor and beneficiary in Richmond, you may recognize some of these concerns:

- “My brother thinks I’m trying to control everything.”

- “The will leaves me the house, but I’m also in charge of the entire estate. Is that unfair?”

- “I work full-time and do not understand probate. What if I make a mistake?”

- “Our family is spread between Richmond, Newport News, and Virginia Beach, and everyone has an opinion.”

These are realistic worries. Probate issues in Virginia involve strict deadlines, court oversight, and detailed accounting requirements. A misstep can delay distribution, increase fees and costs, or lead to disputes among heirs. Working with an estate administration law firm gives you a place to ask questions and access guidance tailored to your situation.

At PJI Law, our estate planning attorneys and probate lawyers provide support in Richmond, VA and throughout Northern Virginia for clients facing this type of dual role as beneficiary and executor.

How Virginia Courts Oversee Executors and Estates

While Virginia law allows executor-beneficiaries, the system is built with checks and balances:

- Circuit Court and qualification: The Circuit Court oversees qualification and may consider objections if someone claims the named executor is not suitable.

- Commissioner of Accounts review: After qualification, the Commissioner of Accounts in each locality reviews inventories and accountings to help protect beneficiaries, heirs, and creditors. The Commissioner can issue show cause orders if required filings are late or incomplete.

- Beneficiary rights: Beneficiaries can request information, raise objections if they believe the executor is mismanaging assets, and, in some cases, petition the court to address concerns.

- Removal of an executor: In serious situations, Virginia law allows for removal of an executor who fails to perform duties, misuses estate property, or engages in misconduct.

Because of this oversight, an executor-beneficiary who takes their responsibilities seriously and works with experienced probate lawyers is often able to complete estate administration smoothly, even when emotions are high.

Executor Compensation vs. Beneficiary Distributions

Another frequent question is whether an executor-beneficiary may accept both a share of the estate and compensation for their services as executor.

Compensation

Virginia law allows reasonable compensation for executors, subject to review and approval by the Commissioner of Accounts. The fee is typically based on the size and complexity of the estate and the effort required. Local norms and guidelines often influence what is considered reasonable. We can address your specific questions during your consultation.

Beneficiary share

Separately, the executor accepts whatever share the will grants them as a beneficiary. This is distinct from compensation and reflects the decedent’s wishes about distributing property and assets among beneficiaries.

As long as the compensation is reasonable and approved, it is generally permissible for an executor to accept both compensation and their inheritance. Still, because other family members may not understand how fees work, it can be wise for executors to discuss anticipated fees with the probate attorney and, when appropriate, explain the structure to beneficiaries. Clear communication can prevent misunderstanding later.

Special Concerns When the Executor Is Also a Major Beneficiary

Being both executor and major beneficiary can create sensitive situations:

- Selling estate property that you want to keep: If you want to purchase a house or other property from the estate, you must handle the transaction at fair market value and often with court or Commissioner oversight. Any appearance of a “sweetheart deal” can trigger objections from other heirs.

- Loans and advances to beneficiaries: An executor-beneficiary might be tempted to “advance” money to themselves or other heirs. Doing so without proper documentation and legal guidance may cause accounting problems or claims of unequal treatment.

- Family businesses and real estate: When the estate includes major assets like a small business in Richmond, a rental property in Glen Allen, or investment real estate in Newport News or Virginia Beach, questions about valuation and ongoing management can impact distributions to all beneficiaries.

If you are facing these scenarios, working with an estate planning lawyer or probate attorney at PJI Law can help you carefully evaluate options, document the process, and protect both yourself and the estate.

What If the Executor Is Also the Trustee of a Trust?

Many Virginia estate plans use both wills and trusts. A revocable living trust might hold substantial assets during the decedent’s lifetime, while the will addresses remaining property and appoints an executor. Sometimes the same person serves as both executor and trustee.

As a trustee, you would owe fiduciary duties to trust beneficiaries, which may include yourself. As the executor, you owe duties to the estate and its beneficiaries and creditors. Trustees and executors must keep careful records, keep trust and estate accounts separate, and follow the terms of the trust and will, as well as Virginia law.

Having the same individual in both roles can simplify administration, but it also increases responsibility. Professional legal guidance can help trustees and executors understand how these roles interact and how to protect beneficiaries and families.

Q&A: Practical Questions About Executor-Beneficiaries in Virginia

Can an executor change what the will says if they think the distribution is unfair?

No. An executor must carry out the will as written and follow Virginia law. The executor does not have the authority to change gifts or percentages simply because they believe the distribution is unfair. However, in some families, beneficiaries may agree among themselves to a different distribution, and those agreements should be documented with the help of an attorney.

What if the executor-beneficiary is not communicating with other family members?

Executors should keep beneficiaries reasonably informed about the status of the probate process, debts, and anticipated distribution timelines. If you are a beneficiary and feel in the dark, you may have options to request information or ask the Commissioner of Accounts or the court to review the situation. Estate planning lawyers can guide you on appropriate next steps.

Can a beneficiary force the executor to step down?

There is no automatic right for a beneficiary to remove an executor simply because they are dissatisfied. However, if an executor fails to file required reports, misuses assets, ignores court orders, or otherwise breaches fiduciary duties, the court can consider removal. A probate lawyer can review the facts and explain whether a petition to the court is appropriate.

Is it safer to choose a non-family executor?

Some people prefer to name a corporate fiduciary or professional in their estate plan, especially when family relationships are strained or assets are complex. Others value the personal knowledge and lower costs of having a family member serve.

The “right” choice depends on factors such as:

- Size and complexity of the estate

- Nature of the assets (real estate, business interests, retirement accounts)

- Relationships among family members

- Location of beneficiaries (for example, spread across Richmond, Newport News, and beyond)

Estate planning attorneys at PJI Law can discuss these factors and help clients choose executors and trustees who fit their goals.

Do I really need a probate attorney if I am both executor and beneficiary?

While Virginia law does not require every executor to hire counsel, the process can be demanding, especially in estates with real property, out-of-state assets, business interests, or disputes. Probate administration lawyers can:

- Explain deadlines, forms, and court requirements

- Assist with inventories and accountings

- Help evaluate debts and taxes

- Provide guidance when beneficiaries disagree

- Reduce the likelihood of costly errors

If you are searching for a “probate attorney near me” in Richmond VA, our firm is available to discuss your situation and help you decide how much assistance you need.

How Good Planning Can Reduce Stress for Future Executors and Families

Thoughtful Virginia estate planning can make life much easier for the person who eventually serves as executor and beneficiary. When working on your own estate plan, consider:

- Clear, detailed wills: Clear instructions about distributing property, especially highly valued items like the family home or business, can reduce misunderstandings later.

- Use of revocable trusts: In some cases, placing assets into a revocable trust may help avoid probate for those assets and streamline administration after death. While no plan can avoid probate in every situation, using trusts and beneficiary designations wisely can reduce court involvement.

- Guardianship provisions for minor children: Parents of minor children can use wills to nominate guardians and address financial support, so the executor and trustee have a clearer roadmap when the unthinkable happens.

- Planning for blended families and divorce history: Prior divorce, remarriage, and blended family situations often increase the possibility of conflict. Crafting a comprehensive estate plan with help from estate planning lawyers can help protect all children, both from current and prior relationships, and provide clarity for a surviving spouse.

- Coordination with other planning: Many clients also have life insurance, retirement accounts, and business arrangements, all of which should be coordinated with their estate planning documents.

PJI Law has served Virginia families for more than a decade with estate planning, probate, and estate administration services, offering tailored plans that reflect each client’s values and goals.

How an Estate Administration Law Firm Can Help an Executor-Beneficiary

When you serve as both executor and beneficiary, you carry considerable responsibility. Our estate administration law firm in Richmond can:

- Review the will and related documents: An attorney at PJI Law can explain your duties as executor, your rights as a beneficiary, and how Virginia law applies to your specific estate.

- Guide you through the probate process: From qualification at the Richmond Circuit Court to final distribution of assets, our probate lawyers can help you understand the process, deadlines, and local procedures, including interactions with the Commissioner of Accounts.

- Assist with inventories, accountings, and taxes: Accurate inventories and accountings protect you and the estate. A probate lawyer at our firm can help structure estate accounts, categorize assets, and prepare documents for review.

- Address disputes among heirs or beneficiaries: If another beneficiary questions your decisions as executor, having a law firm involved can provide a neutral explanation of the law and, when necessary, represent you in court proceedings.

- Coordinate with other legal matters: Sometimes estate administration intersects with other issues, such as personal injury claims, business succession, divorce history, or guardianship concerns. Working with attorneys familiar with these aspects of Virginia law can be especially helpful.

Considering Your Options: Should You Accept the Role of Executor if You Are a Beneficiary?

If a loved one’s will names you executor and you are also a beneficiary, you have choices. You may:

- Accept the appointment and work with a probate attorney to fulfill your duties

- Decline to serve and allow an alternate executor or administrator to be appointed

- Serve with support, by hiring an estate administration law firm to assist with day-to-day tasks

When deciding, consider:

- Your time and availability

- The size and complexity of the estate

- The condition of relationships among family members

- Whether there are significant assets that need oversight

- Your own comfort level with financial and legal responsibilities

Discussing these factors with an attorney can help you make informed decisions about accepting or declining the role.

Schedule a Consultation with a Richmond Probate Lawyer at PJI Law

If you are asking whether an executor of a will can be a beneficiary in Richmond, Virginia, you are likely facing the recent death of a loved one and trying to honor their wishes while also protecting your own rights and your family. You do not need to manage this process alone.

PJI Law provides Virginia estate planning, probate, and estate administration services in Richmond, Virginia. Our attorneys help clients understand the responsibilities of executors, trustees, and beneficiaries. We guide our clients in an approach to estate administration that respects both the law and family relationships.

Whether your loved one owned a home, had retirement accounts, or left real property in Richmond, working with local probate counsel can offer peace of mind during a difficult time. Our firm can assist with:

- Reviewing the will and overall estate plan

- Guiding executors and trustees

- Preparing inventories and accountings

- Working through complex probate issues

- Coordinating with tax professionals and financial advisors

- Protecting the interests of beneficiaries and estates under Virginia law

If you are serving as both executor and beneficiary, or if you have questions about a Virginia estate plan, we invite you to discuss your situation with our team. Call PJI Law at (703) 865-6100(703) 865-6100 or contact us through our online form to schedule a free consultation with our probate and estate planning attorneys serving Richmond, VA.

We are here to provide clear legal guidance so you can focus on taking care of your family and honoring your loved one’s wishes.

Copyright © 2025. PJI Law, PLC. All rights reserved.

The information in this blog post (“post”) is provided for general informational purposes only and may not reflect the current law in your jurisdiction. No information in this post should be construed as legal advice from the individual author or the law firm, nor is it intended to be a substitute for legal counsel on any subject matter. No reader of this post should act or refrain from acting based on any information included in or accessible through this post without seeking the appropriate legal or other professional advice on the particular facts and circumstances at issue from a lawyer licensed in the recipient’s state, country, or other appropriate licensing jurisdiction.

PJI Law, PLC

4108 E Parham Rd,

Richmond, VA 23228

(703) 865-6100(703) 865-6100

https://www.pjilaw.com/

Tell Us What Happened

Call Now: (703) 865-6100(703) 865-6100

* Required Fields

By contacting PJI Law, PLC by any means, you agree that you are not forming an attorney-client relationship. You agree that any information you provide may not remain confidential nor be protected by the attorney-client privilege. Before we can represent you, we have to ensure that there are no conflicts of interest; therefore, do not share any confidential information, and/or information that could harm you if revealed to another party in your matter, until you have entered into a written agreement with us. An attorney-client relationship cannot be formed without a written agreement signed by PJI Law, PLC.