How To Transfer Property to a Trust in Richmond, Virginia

Protecting Your Family and Property Through a Trust

Many individuals face uncertainty about whether their family members will be burdened with court intervention, unnecessary taxes, or disputes if something happens to them. Others worry about how their property and financial assets will be managed if they become incapacitated. If you’re searching for guidance on how to transfer property to a trust in Richmond, Virginia, chances are you’re concerned about protecting your estate, avoiding lengthy probate proceedings, and making life easier for your loved ones after your passing.

At PJI Law, our Richmond estate planning lawyers frequently hear these concerns, and we help clients make informed decisions to protect their family’s future through well-structured trusts and related estate planning documents. Below, we explain the legal process in Virginia for transferring property into a trust, why it matters, and the steps you need to take to safeguard your estate.

Understanding the Purpose of a Trust in Virginia

A trust is a legal tool that allows you to transfer ownership of your property and assets to be managed by a trustee for the benefit of your chosen beneficiaries. Under Virginia law, trusts can be structured in many ways depending on your goals:

- Revocable living trust: Allows you to maintain control during your lifetime while providing for smooth transfer of property at death.

- Irrevocable trust: Can help protect assets from creditors, minimize estate tax exposure, and benefit heirs across generations.

- Specialized trusts: Such as generation skipping trusts, irrevocable life insurance trusts, or family limited partnerships.

Each trust type serves different purposes, from tax planning to asset protection, and should be reviewed with a trust and estate planning attorney.

Why Transfer Property to a Trust?

Transferring your property into a trust provides several benefits under Virginia probate law:

- Avoid probate: Property held in a properly funded trust passes directly to beneficiaries, reducing delays and costs.

- Protect loved ones: A trust can shield your family from unnecessary litigation or fiduciary disputes after death.

- Maintain privacy: Unlike probate proceedings, trusts are generally private and not part of public court records.

- Flexibility for family situations: Trusts allow careful planning for second marriages, minor children, and heirs with unique financial needs.

- Estate tax planning: Certain trust structures may help reduce estate tax exposure in larger estates.

The Legal Process of Transferring Property to a Trust in Richmond, Virginia

Once you have worked with your attorney to create a trust, the next step is properly transferring your property and other assets into it. This process, sometimes referred to as “funding the trust,” is essential for the trust to work as intended.

1. Identify the Assets to Transfer

Your estate may include:

- Real property (homes, rental properties, land)

- Financial assets (bank accounts, investments, retirement accounts)

- Business interests (limited liability companies or family limited partnerships)

- Life insurance policies

- Personal property with significant value

2. Retitle Property in the Name of the Trust

In Virginia, property deeds must be formally recorded to reflect the trust as the new owner. This requires preparing and filing a new deed with the local circuit court in Richmond or the county where the property is located.

3. Work with Financial Institutions

Banks and investment firms often require specific forms or documentation to retitle accounts in the name of the trust. The trust attorneys at PJI Law can assist in communicating with these institutions.

4. Update Beneficiary Designations

Certain assets, such as retirement accounts and life insurance, pass through beneficiary designations. Updating these to align with the trust’s terms is a key part of comprehensive estate planning.

5. Review and Maintain Your Trust

Over time, your assets and family circumstances may change. It is important to regularly review your estate planning documents and update them as needed to reflect your current wishes.

The Role of Trustees and Beneficiaries

When you transfer property to a trust, the trustee takes on fiduciary responsibilities to manage the assets according to the trust’s terms. Beneficiaries receive the benefit of those assets as directed. In Virginia, trustees must follow the trust document carefully and may be subject to fiduciary litigation if they breach their duties.

Beneficiaries, on the other hand, have rights under probate law and trust and estate law to hold the trustee accountable. Working with an experienced trust and estate planning attorney helps prevent trust and estate disputes.

Other Considerations in Estate Planning

At PJI Law, we recognize that transferring property to a trust is just one part of a comprehensive estate plan. Additional considerations may include:

- Drafting wills to handle property outside the trust

- Powers of attorney for financial affairs

- Advance medical directives and living wills for healthcare decisions

- Guardianship and conservatorship proceedings for minor children or incapacitated adults

- Business succession planning for privately held businesses

- Estate administration after death, including addressing creditors and taxes

By addressing these areas together, you can protect both your family and your estate.

Avoiding Common Pitfalls

One of the biggest mistakes clients make is creating a trust but failing to transfer property and assets into it. Without funding, a trust cannot help avoid probate or protect beneficiaries.

Another common issue arises when individuals fail to regularly review their estate planning documents, especially after major life events such as marriage, divorce, second marriages, or the birth of children or grandchildren.

A Richmond law firm experienced in estate planning can help you avoid these pitfalls by guiding you through the funding process and long-term trust administration.

Funding Real Property into a Trust

One of the most common and important steps in Virginia estate planning is transferring real estate into a trust. This includes your primary residence, vacation property, or rental real estate. If you transfer real property into a revocable living trust, you maintain control during your lifetime while making the transfer of ownership upon your death smoother and keeping it outside of probate.

- If you do not fund the trust: The property will likely pass through probate, which can create unnecessary delays and costs for your beneficiaries.

- If you do fund the trust: The trustee can transfer ownership directly to the beneficiaries without court intervention, preserving privacy and streamlining the process.

Recording the deed in the name of the trust with the appropriate circuit court in Richmond or the locality where the property is located is an essential step for the transfer to be effective.

Bank Accounts and Investment Accounts

Bank accounts and non-retirement investment accounts can also be funded into a trust. Financial institutions may require documentation before retitling the accounts.

- If left outside the trust: These accounts may be subject to probate, unless they have payable-on-death designations, which might not align with your overall estate plan.

- If transferred into the trust: The trustee gains authority to manage them for your benefit during your lifetime and for your beneficiaries after death, keeping the process private and often more efficient.

Retirement Accounts and Beneficiary Designations

Retirement accounts, such as IRAs and 401(k)s, are treated differently. These accounts usually transfer directly to named beneficiaries. However, trusts may be designated as beneficiaries in certain cases where you want more control over how distributions are made.

- If you name individuals directly: Funds go to the beneficiaries, but without additional protections.

- If you name a trust as beneficiary: You may direct distributions over time, protect beneficiaries with financial challenges, or coordinate with second marriages.

Failure to align your retirement account designations with your estate planning documents can cause conflicts and unintended distributions.

Life Insurance and Irrevocable Life Insurance Trusts

Life insurance proceeds can be significant. Many clients create irrevocable life insurance trusts to remove life insurance from their taxable estate while still providing for loved ones.

- Without a trust: Life insurance proceeds may increase the size of your estate for estate tax purposes.

- With a trust: The proceeds can be used to provide liquidity for estate administration, to cover taxes, or to benefit beneficiaries in a controlled way.

Business Interests

For clients who own closely held businesses, including limited liability companies or family limited partnerships, transferring ownership interests into a trust is an important part of business succession planning.

- If left outside the trust: Business interests may be tied up in probate proceedings, causing disruption and uncertainty.

- If placed into the trust: The trustee may manage or distribute the interests according to your plan, supporting continuity and protecting your family’s financial affairs.

Personal Property and Other Assets

Personal assets with substantial value, such as jewelry, art, or collectibles, can also be transferred into a trust. Vehicles may also be transferred, though in some cases, clients prefer to use transfer-on-death registrations.

- If these assets are omitted from the trust: They may still pass through probate, which can create complications and potential disputes.

- If these assets are included in the trust: They can be distributed smoothly according to the trust’s terms.

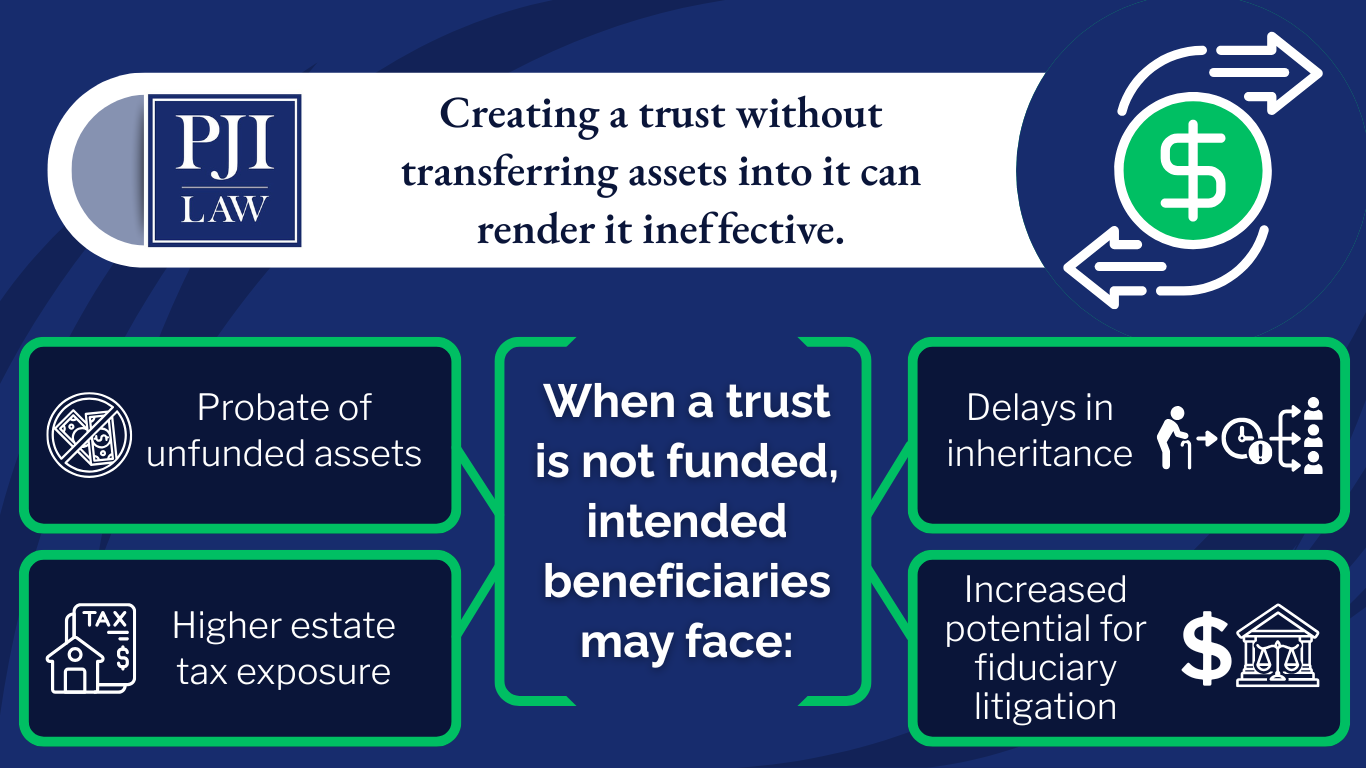

The Consequences of an Unfunded Trust

One of the most common and avoidable mistakes in estate planning is failing to fund a trust. In Virginia, creating a trust without transferring assets into it can render it ineffective.

When a trust is not funded, intended beneficiaries may face:

- Probate of unfunded assets

- Delays in inheritance

- Higher estate tax exposure

- Increased potential for fiduciary litigation

On the other hand, once you fund the trust, you give the trustee the legal authority to manage the assets for your benefit during your lifetime and according to your wishes upon your death. This not only protects your heirs but also reduces the likelihood of trust and estate disputes.

Implications of Placing Assets into Trusts

When assets are placed into a trust:

- Control: In a revocable living trust, you retain control of assets while alive.

- Protection: In an irrevocable trust, assets are no longer under your direct control, but they may be shielded from creditors and excluded from estate tax calculations.

- Privacy: Trusts keep your financial affairs private compared to public probate proceedings.

- Beneficiary protection: You can structure distributions to protect beneficiaries who may be young, financially inexperienced, or going through second marriages.

Take the Next Steps to Protect Your Legacy with PJI Law in Richmond, Virginia

Understanding how to transfer property to a trust in Richmond, Virginia, is a significant step toward protecting your estate, your loved ones, and your family’s future. At PJI Law, we serve clients throughout Richmond, Virginia, and Northern Virginia with thoughtful estate planning solutions tailored to their needs. If you were searching for “trust attorney near me” in Richmond, we are here to guide you. Whether you are considering a revocable living trust, an irrevocable trust, or you need assistance with trust administration, our attorneys are here to assist you in planning for your estate and protecting your beneficiaries.

At PJI Law, we help our clients create tailored estate planning solutions to meet the unique needs of their families. Our practice areas include wills, trusts, trust administration, probate administration for an executor/personal representative tasked with estate administration, and much more.

Contact us at (703) 865-6100(703) 865-6100 or complete our online form to schedule a consultation. Together, we’ll protect your loved one’s future and provide the support they need to thrive.

Copyright © 2025. PJI Law, PLC. All rights reserved.

The information in this blog post (“post”) is provided for general informational purposes only and may not reflect the current law in your jurisdiction. No information in this post should be construed as legal advice from the individual author or the law firm, nor is it intended to be a substitute for legal counsel on any subject matter. No reader of this post should act or refrain from acting based on any information included in or accessible through this post without seeking the appropriate legal or other professional advice on the particular facts and circumstances at issue from a lawyer licensed in the recipient’s state, country, or other appropriate licensing jurisdiction.

PJI Law, PLC

4108 E Parham Rd,

Richmond, VA 23228

(703) 865-6100(703) 865-6100

https://www.pjilaw.com/

Tell Us What Happened

Call Now: (703) 865-6100(703) 865-6100

* Required Fields

By contacting PJI Law, PLC by any means, you agree that you are not forming an attorney-client relationship. You agree that any information you provide may not remain confidential nor be protected by the attorney-client privilege. Before we can represent you, we have to ensure that there are no conflicts of interest; therefore, do not share any confidential information, and/or information that could harm you if revealed to another party in your matter, until you have entered into a written agreement with us. An attorney-client relationship cannot be formed without a written agreement signed by PJI Law, PLC.