Do All Wills Go Through Probate in Virginia?

When a loved one passes away, you’re often left facing more than grief. Alongside funeral arrangements and family responsibilities, you may suddenly find yourself sorting through their financial papers, locating important documents, and wondering what to do next. For many families in Northern Virginia, one of the first questions that arises is: Do all wills go through probate in Virginia?

It’s not unusual to feel uncertain about the probate process, especially if this is the first time you’ve dealt with a loved one’s estate. Some people assume that having a will automatically means a simple transfer of property, while others fear that probate always means a lengthy court battle. The truth lies somewhere in between. Whether probate is required depends on the type of estate assets left behind, how they were titled, and what planning steps were taken before death.

To answer the question of whether all wills go through probate in Virginia, this blog explains when probate is required, when it can be avoided, and how those differences can affect families already coping with loss.

Defining Probate in Virginia

Probate is the legal process through which a court oversees the administration of a deceased person’s (decedent) estate. In Virginia, this takes place in the circuit court of the city or county where the person lived. During probate, the court validates the will (if one exists), appoints a personal representative, and gives that representative the authority to manage estate assets. The representative’s duties include paying legitimate debts and taxes before distributing the remaining property to heirs or beneficiaries.

A will by itself does not transfer property. It only takes effect for legal purposes once the court admits it to probate and records it, which makes it operate like a deed in transferring title (Va. Code § 64.2-455). If there is no valid will, Virginia’s intestacy laws determine how the estate is distributed.

Situations That Require Probate

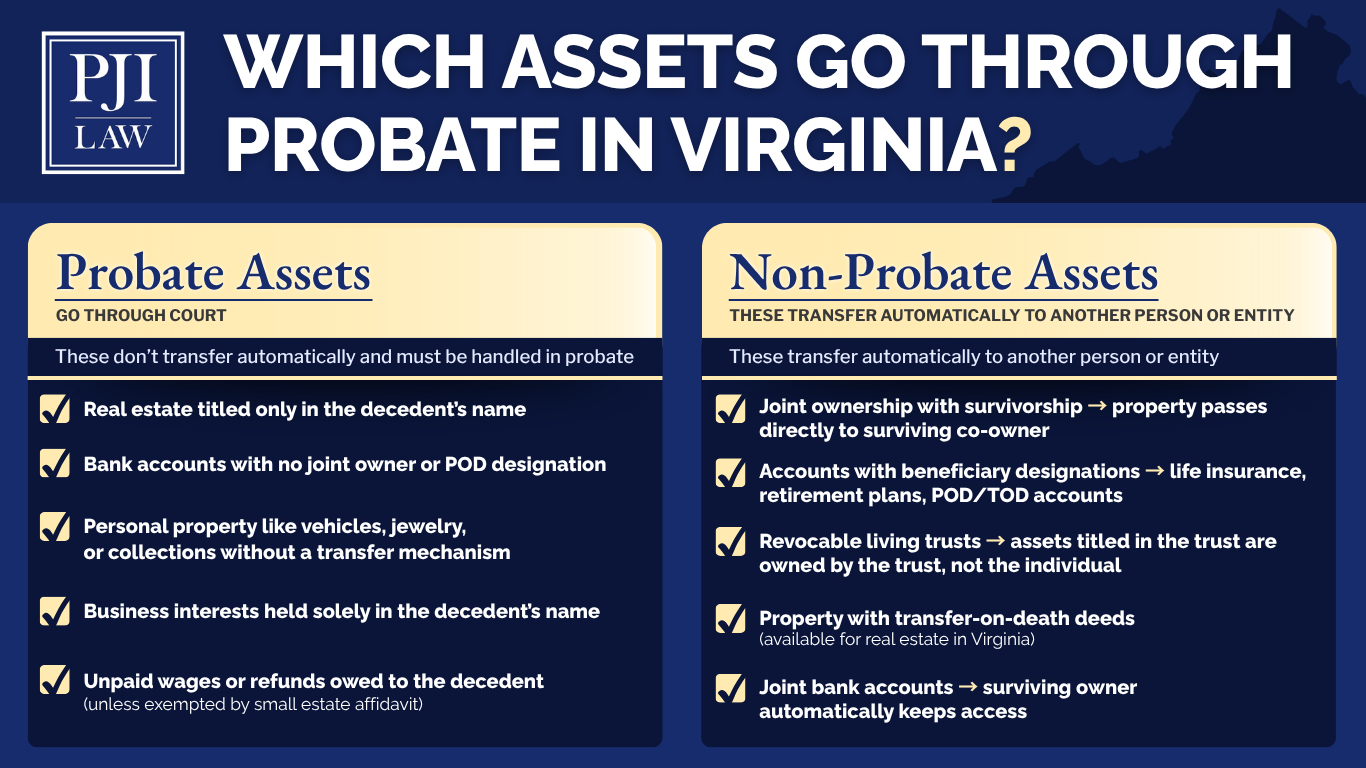

Probate becomes necessary when a person dies owning property that cannot be transferred automatically under Virginia law. Common examples include:

- Real estate titled solely in the decedent’s name

- Bank accounts without joint ownership or payable-on-death beneficiaries

- Personal property such as vehicles, jewelry, or valuable collections without a transfer mechanism

In these cases, the circuit court must open a probate estate so the personal representative can legally retitle or distribute the property. Just as some estates require probate, others do not. Virginia law provides several ways property can pass outside the probate process.

When Probate Is Not Required

Some estates do not need to go through probate because assets already have a built-in way to transfer ownership. In Virginia, this can happen in several common situations:

- Joint ownership with survivorship. Property such as homes or bank accounts held in joint names usually pass automatically to the surviving owner.

- Accounts with beneficiary designations. Life insurance, retirement accounts, and payable-on-death accounts transfer directly to the named beneficiaries.

- Revocable living trusts. Property placed in a trust during life generally avoids probate because the trust, not the individual, is considered the owner.

Virginia law also provides a simplified process for small estates. If the total probate estate is valued at $75,000 or less, heirs may use a small estate affidavit under Va. Code § 64.2-601 instead of opening probate. The affidavit must state that at least 60 days have passed since the decedent’s death and confirm that the estate qualifies under the $75,000 limit. It also must include the decedent’s information, the names and addresses of the heirs or beneficiaries, and signatures from the successors, and it must be notarized. Once complete, the affidavit can be presented to banks or other institutions to release funds.

This option applies only to personal property, not real estate, but it can make the process easier for families dealing with modest estates. For example, if a loved one left behind only a checking account or vehicle in their own name, you may be able to transfer it with an affidavit rather than a full probate proceeding.

Because the distinction between probate and non-probate assets is so important, here’s a visual summary you can use as a quick reference:

The Estate Administration Process in Virginia

When probate is required, estate administration follows a series of steps under Virginia law. It begins when the death certificate and the will are filed with the circuit court. The court then appoints a personal representative, who is called an executor if named in the will or an administrator if not.

Once appointed, the personal representative must complete several key tasks:

- Collect and inventory estate assets. This includes real property, bank accounts, personal property, and other financial holdings. The inventory must be filed with the Commissioner of Accounts.

- Identify and pay debts and taxes. This may involve reviewing outstanding bills, paying legitimate creditor claims, and filing tax returns. In some cases, federal estate tax obligations also apply.

- Distribute assets. Only after debts and taxes are paid can assets be distributed to beneficiaries. If there is no valid will, property is distributed under Virginia’s intestacy laws, which determine heirs by family relationship.

The process also comes with court-imposed deadlines. Most Virginia estates take 18 to 24 months to close, but the timing depends on complexity. By law:

- The inventory is due within four months of qualification.

- The first accounting is due within 16 months.

Filing probate promptly, ideally within about 30 days after death, helps keep the process on schedule, though disputes, tax filings, or creditor issues can extend the timeline.

Probate in Complex Estates

While some estates are straightforward, others raise complicated issues that make probate more challenging. Disputes are common when there is no valid will and family members disagree over who should inherit. Large estates with multiple beneficiaries may require careful accounting, especially if estate assets include business interests or property in joint names across more than one state.

Creditors can also make administration more difficult. Nursing home claims or unpaid medical bills may lead to contested hearings, and estates with significant debts can leave the personal representative in a difficult position. In some cases, the Commissioner of Accounts or the probate court may require more detailed reporting and oversight, extending the timeframe of administration.

Complex estates highlight why probate is not simply paperwork but a legal process that can vary depending on the facts of each case.

How Probate Affects Families

Probate is not only a legal process; it has real effects on families already dealing with loss. The process can influence emotions, finances, and even the privacy of the estate.

Timing often feels difficult. Probate occurs during a painful period and adds deadlines, filings, and court oversight that can feel overwhelming. Many estates in Virginia take 18 to 24 months to settle, and beneficiaries may need to wait before they may be able to receive their inheritance.

Costs also play a role. Virginia does not impose an estate tax, but there is a probate tax of $0.10 per $100 on estates valued above $15,000 (Va. Code § 58.1-1712). Local governments may add another one-third of the state tax. Clerk’s fees for filing and recording wills add to the total. While each fee may appear small, together they reduce what ultimately passes to heirs.

Privacy is another concern. Once a will is admitted to probate, it becomes a public record. That means details about assets and beneficiaries are available to anyone who requests them, something many families find uncomfortable.

Because of these challenges, many families choose to work with a probate lawyer who can manage the process and ease the burden.

How a Probate Lawyer Can Support You

Probate involves more than filing forms with the court. For families already coping with loss, it can mean sorting through financial records, handling creditor claims, and making sure every filing meets Virginia’s legal deadlines. Even a small mistake can slow the process or leave the personal representative personally liable for unpaid debts or taxes.

A probate lawyer in Northern Virginia can step in to manage these responsibilities and protect you from unnecessary risk. Their support often includes:

- Preparing and filing court documents. The court requires timely inventories and accountings, and errors can lead to delays or penalties. An attorney makes sure filings are accurate and on schedule.

- Advising the personal representative. Executors and administrators carry a fiduciary duty to act in the best interests of beneficiaries. Legal guidance helps them meet that standard and avoid being held personally liable.

- Handling creditor claims. Medical providers, nursing homes, and credit card companies often file claims against estates. An attorney can review and dispute questionable claims while making sure legitimate debts are paid.

- Overseeing asset distribution. From real estate sales to transferring bank accounts, an attorney oversees asset distribution so it complies with the will or, if there is no will, Virginia’s intestacy laws.

- Managing disputes. Probate often stirs conflict between heirs or with creditors. Having counsel in place can prevent disagreements from escalating into full legal battles.

With an attorney guiding the process, families can move forward knowing the estate is handled properly, deadlines are met, and risks are minimized.

Questions About Probate in Virginia? Contact PJI Law

Questions about whether a will must go through probate can feel overwhelming, especially when you are already balancing family responsibilities and grief. At PJI Law, our probate lawyers in Virginia provide guidance at every stage of the probate process. From determining whether probate is required to managing court filings, creditor claims, and asset distribution, we take on the legal details so you can focus on your family.

When you search online for “probate law firms near me,” you want more than a list of names. You want a law firm that understands the challenges of probate and can give you clear direction. Each probate lawyer at PJI Law is committed to providing families throughout Fairfax County and Northern Virginia with white glove service and personal attention.

Call PJI Law at (703) 865-6100(703) 865-6100 or contact us online to schedule your complimentary consultation. Whether you’re facing probate now or need clarity on whether it applies to your loved one’s estate, we are here to guide you through the process.

At PJI Law, you’ll receive white glove service and personal attention from a team that treats you like family.

Copyright © 2025. PJI Law, PLC. All rights reserved.

The information in this blog post (“post”) is provided for general informational purposes only and may not reflect the current law in your jurisdiction. No information in this post should be construed as legal advice from the individual author or the law firm, nor is it intended to be a substitute for legal counsel on any subject matter. No reader of this post should act or refrain from acting based on any information included in or accessible through this post without seeking the appropriate legal or other professional advice on the particular facts and circumstances at issue from a lawyer licensed in the recipient’s state, country, or other appropriate licensing jurisdiction.

PJI Law, PLC

3900 Jermantown Road, #220

Fairfax, VA 22030

(703) 865-6100(703) 865-6100

https://www.pjilaw.com

Tell Us What Happened

Call Now: (703) 865-6100(703) 865-6100

* Required Fields

By contacting PJI Law, PLC by any means, you agree that you are not forming an attorney-client relationship. You agree that any information you provide may not remain confidential nor be protected by the attorney-client privilege. Before we can represent you, we have to ensure that there are no conflicts of interest; therefore, do not share any confidential information, and/or information that could harm you if revealed to another party in your matter, until you have entered into a written agreement with us. An attorney-client relationship cannot be formed without a written agreement signed by PJI Law, PLC.